Financial markets are ever-changing and can be extremely complex and volatile. Our Discretionary Portfolio service allows us to make sense of market movements on your behalf and to move quickly in situations of new opportunity or sudden change.

Put simply, we do the groundwork for you, taking on your financial goals as our own and putting our deep market insights and analytical expertise to work. By entrusting us to invest, monitor and adjust your portfolio within your agreed parameters, you can take advantage of opportunities without being exposed to unnecessary risk.

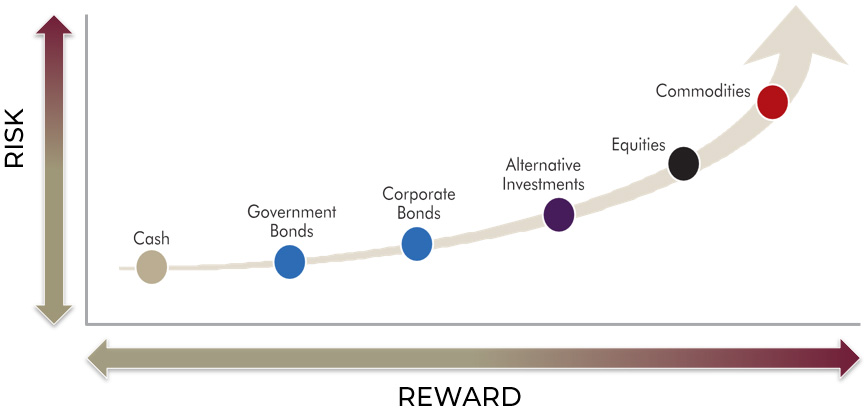

Striking the right balance when building a portfolio is critical. That is why we strive to find investments that maximise returns when financial markets are favorable and that provide protection during market downturns.

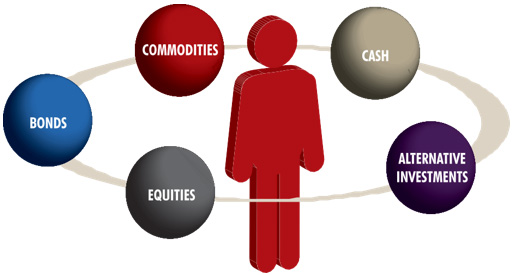

A simple to understand, multi-asset Portfolio designed to maximise performance when markets are calm and dampen the volatility during periods of uncertainty. Our actively managed multi-asset portfolio offers a wealth of investment asset classes, including:

EQUITIES - as global growth expands equities are usually the best placed asset class to benefit

BONDS - Offer an income stream in addition to a degree of capital protection, dependent on the credit quality of the issuer

COMMODITIES - Are probably the worlds more valuable assets and often offer a hedge against inflation

ALTERNATIVE - Provide access to skill-based strategies, often acting as a hedge against traditional investments

CASH - Useful buffer in uncertain times and should also be held to take advantage of opportunities

For all enquiries you can call us on +353 87 292 4226 or click below to send us an email.

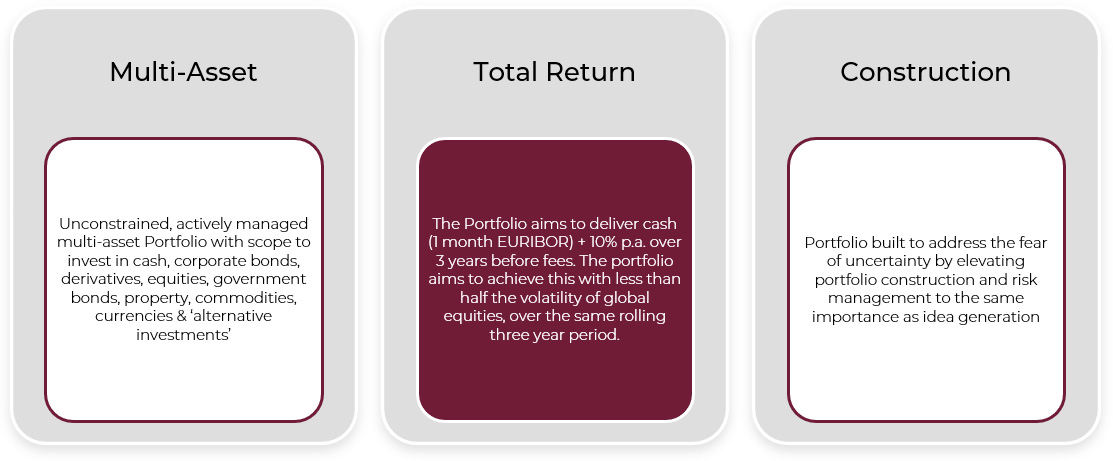

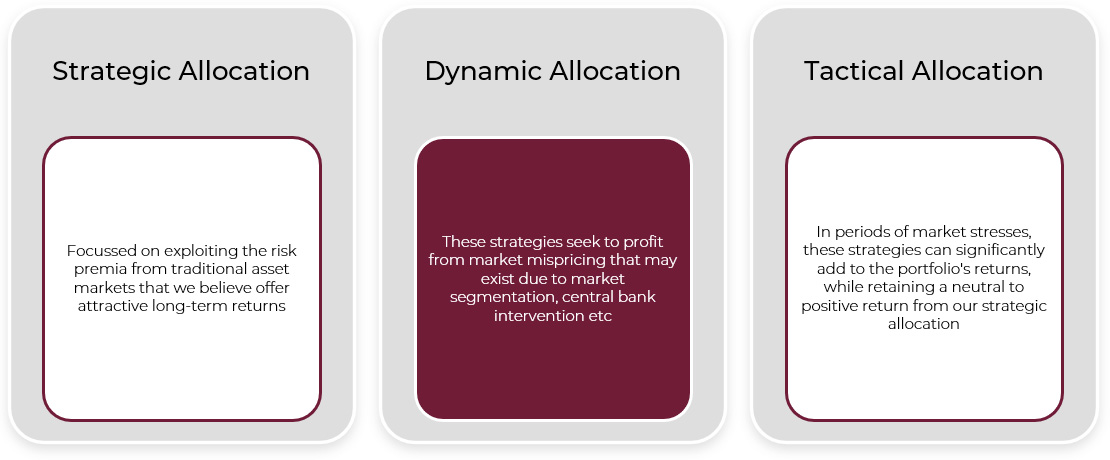

The portfolio invests in a wide range of strategies which combine to diversify the risk in the portfolio and to help the portfolio perform in many different market conditions. By combining strategies effectively, the team aim to generate lower risk than the sum of the risk of each individual strategy.

Our Investment Process can be divided up into three simple to understand stages.

We then create your bespoke portfolio that combines both return generating assets and risk mitigating strategies.

Your outcome-focused portfolio will be built to preserve capital in all financial market conditions and to offer more sources of potential return than in traditional portfolios. By actively investing on your behalf, we will build a portfolio that comprises the most compelling investment opportunities we can find across asset classes and markets.